Commentaries

Fatih Özatay, PhD - [Archive]

Turkey’s exports in Euro and Dollar terms 24/06/2010 - Viewed 2105 times

We must admit that the current problems of the European Union (EU) furnished us with a lot of material to write on. One among these was that Turkey's exports will be affected negatively both as the domestic demand across EU would drop due to the tightening measures planned to be implemented and as Euro would depreciate.

Taking departure from this diagnosis, I talked quite a lot on exports recently. On Sunday, I even wrote a 'remedying prescription'. This courage of ignorance always makes you seek a thing to save. So let me take a look at the recent developments in terms of export performance. Maybe there is nothing to save there.

Turkey makes exports in exchange of Euros or Dollars in general. TURKSTAT announces the value of exports made in exchange of both currencies in Dollar terms. To put it differently, Turkey's exports in exchange of Euros are converted into dollars by TURKSTAT on the basis of the exchange rate for the date the export transaction took place. In order to find out figures on exports to both regions net of exchange rate volatilities, I reversed the calculation made by TURKSTAT. Using the average euro/dollar parity, I calculated the exports in exchange of Euros in Euro terms.

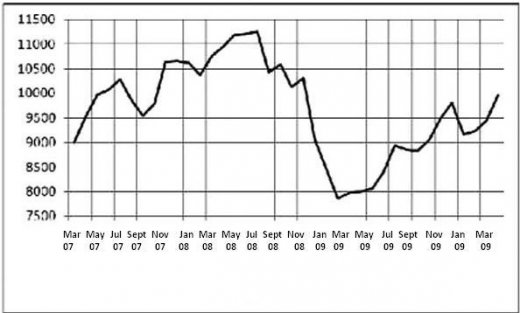

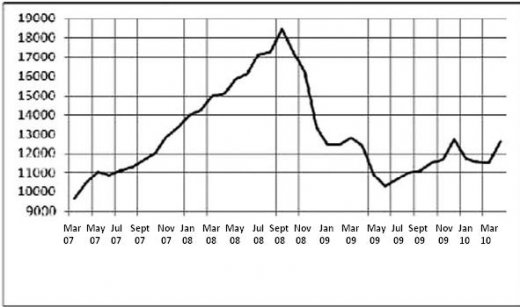

Graph 1 shows the movements in the Euro value of exports in Euro terms. Though the sentence looks weird, it is necessary to underline as the figures are reported originally in Dollar terms. The graph covers the period between March 2007 and April 2010. I will take into account the total exports in preceding three months to avoid monthly volatilities. Graph 2 shows the change in the Dollar value of exports in Dollar terms.

It is possible to reach some conclusions: first, compared to the peak level before the global crisis, exports in exchange for Euros dropped less compared to Dollars; by 30% and 44% respectively. Second, exports in exchange for Euros started to recover earlier than exports in exchange for Dollars. Third, since the month where export hit the trough, exports in exchange for Euros and for Dollars increased by 27 and 22 percent, respectively. Fourth, value of exports in exchange for Euros is closer to the peak level before the crisis as compared to that in exchange for Dollars. Let us remember that export level for one month was calculated using the levels for the preceding three moths.

In this context, risk of weak recovery across EU countries and depreciation of Euro might have adverse effects on Turkey's exports. Note: Depreciation of Euro will increase Euro's exports to other regions. This can have a positive effect on their demand for imported intermediate goods from Turkey. Therefore, this can offset the adverse affects mentioned in recent commentaries to a certain extent. Albeit, I do not 'believe' it can offset the adverse affects to a considerable extent. (I do not 'believe' because I did not make any calculations on this).

Graph 1: Value (in Euro terms) of exports in exchange for Euros: March 2007 - April 2009 (million Euros, sum of preceding three months for each month)

Graph 2: Value (in Dollar terms) of exports in exchange for Dollars: March 2007 - April 2009 (million Dollars, sum of preceding three months for each month)

This commentary was published in Radikal daily on 24.06.2010