Commentaries

Fatih Özatay, PhD - [Archive]

Latest developments 07/06/2009 - Viewed 1635 times

Table 1: Automobile production and import levels (units)

|

|

|

January |

February |

March |

April |

May |

|

Automobile production |

2008 |

61507 |

60868 |

64973 |

65610 |

63931 |

|

|

2009 |

23838 |

30192 |

37125 |

48566 |

52631 |

|

|

Change (%) |

-61.2 |

-50.4 |

-42.8 |

-26.0 |

-17.7 |

|

Automobile imports |

2008 |

12792 |

14938 |

22022 |

19313 |

20927 |

|

|

2009 |

8044 |

9934 |

29948 |

22787 |

28810 |

|

|

Change (%) |

-37.1 |

-33.5 |

36.0 |

18.0 |

37.7 |

Today's column will be rich in terms of figures and numbers because now it is time to take a look at the latest developments. First of all, let us evaluate the impact on the automotive sector of the tax cut in effect from mid-March to mid-June as is the top priority item of my obsession list. Last figures I have provided were for April and now figures for May have been announced.

Table-1 comparatively provides the production and import data for the first five months in 2008 and 2009. There is nothing different than I argued in the first commentary I have written after the announcement of tax cut. Yes, the decision enables a slight movement in production level (fall in production level is limited in April and May); however, the main impact is on imports. In comparison with April and May 2008 where the impacts of the crisis was not felt yet and imports were made with full speed, automobile imports in April and May 2009 are considerably higher.

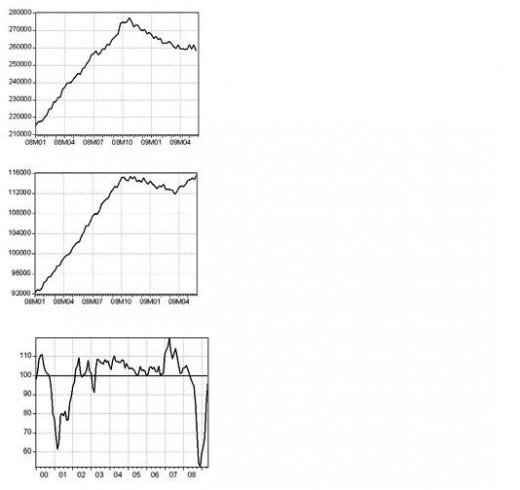

I mentioned a couple of weeks ago that the erosion seen in the volume of total loans extended by banks has recently stopped. This is validated as well by the latest data announced on May 22 (Graph 1). On the other hand, the increase in consumer loans observed over a couple of previous weeks is gradually getting more prominent (Graph 2). Rise in confidence indices go on. Maybe the most important one among these, real confidence index calculated by the Central Bank almost rose to a neutral level (100 points) (Graph 3). These are the good news.

Exogenous negative developments however remain present. Most 'up-to-date' data on the foreign resource usage by the corporate and the banking sector is for March. I have mentioned this before: Both sectors, after they paid the due foreign debt in 2007, have received 31.4 billion USD of foreign resources in sum. However, for the first quarter of this year, they have transferred 3.4 billion USD. We will see that this unfavorable trend continues as new data is announced.

Second exogenous problem is the low level of demand for the goods exported by Turkey. Over the first four months of 2009 exports in average decreased by 28 percent as compared to the same period in 2008. As Turkish Exporters' Assembly data suggests, exports in May 2009 was 40 percent lower than that in May 2008.

And the newly-announced economic policies... There is nothing new on that respect: "One positive, one negative". Decisions about the labor market are positive as they are directed at low income groups and as they will work in the direction of stimulating domestic demand. Incentive policy reflects a broader initiative which I will touch upon later. The negative aspect of the announced policies is that we do not know what the burden on the budget will be, whether or not this burden will be compensated in the future, and how if it will be compensated. There is no medium term fiscal rule announced yet.

Another negative aspect is that we were too late in making these decisions. I will mention the potential impacts of this delay referring to the interesting speech FED President Bernanke gave this week.

Graph 1: Total credits (4 January 2008 - 22 May 2009; million liras)

Graph 2: Consumer loans (4 January 2008 - 29 May 2009; million liras)

Graph 3: Real sector confidence index (January 2000 May 2009)

This commentary was published in Radikal daily on 07.06.2009