Commentaries

Fatih Özatay, PhD - [Archive]

Need for a new economic program (3) 26/11/2011 - Viewed 1475 times

Turkey’s trade deficit heals during crises, but this is not exactly pleasing as the underlying reason of this improvement is the contraction of the economy.

Merkel, Sarkozy and new Italian Prime Minister, Monti, met in Strasbourg on Thursday. During the press meeting, Merkel reiterated her opposition to the proposal to issue a common bond, Eurobond, or to the intervention of the European Central Bank putting its weight behind the debt crisis. In short, Germany persists on its acknowledged attitude. According to many analysts, however, this attitude is about to cause Europe to hit the brick wall at full speed. Meanwhile, the Joint Select Committee on Deficit Reduction of the US has failed before reaching any agreement. Republicans once again opposed to the plan to raise tax rates in expense of the rich while Democrats went up against the proposal to cut certain expense items.

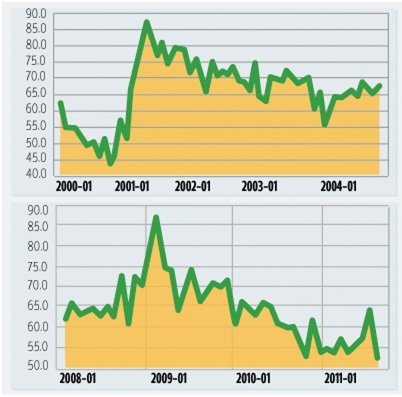

In short, things are not going well in Europe or in the US. The situation is disastrous particularly in Europe. The risk of a major European crisis will rise unless Europeans can pull a rabbit out of the hat. This is bad news for Turkey. In today’s commentary of the “need for a new economic program” series, I will focus on a phenomenon that becomes visible in Turkey during crisis periods. Below are two figures showing the export/import ratio for Turkey with seasonally adjusted data. First one gives the outlook of the export/import ratio for the period before, during and after the 2001 crisis while the second does the same for the global financial crisis. I did not want to populate the commentary with figures, so I am not addressing previous crisis. I just want to stress that this phenomenon had applied also during the 1998-1999 Russian crisis and the “home-made” crisis of the 1994.

The phenomenon depicted in below figures is that, during crisis periods, export/import ratio rises rapidly. The value attained during the first months of 2001 and 2009 clearly validates this situation. However, the ratios are quite low during the periods before and after crises. The part for the pre-crisis period must not be considered as causality. That is, we cannot conclude, “exports dropped in comparison with imports; then, risks for a crisis in Turkey grew.” Evidently, the fall in the ratio increases economic problems in Turkey. But alone, it is not necessarily the sole factor triggering the risk of a crisis.

The main message delivered by the figures can be summarized as follows: during crisis periods, Turkey’s trade deficit heals considerably. The same can be observed for current account deficit when foreign exchange revenue-expenditure other than export-import of goods and services (for instance revenue/expenditure on tourism or construction services) are considered. However, the deal here goes beyond the healing of foreign trade or current account deficits. The chief reason why the export/import ratio increases during crises is the rapid fall in imports. In the previous commentary of the series, I verified that movement of imports and national income was harmonious and bonded. Thus, Turkey’s trade deficit heals during crises, but this is not exactly pleasing as the underlying reason of this improvement is the contraction of the economy.

Figure 1. Export/Import ratio during the 2001 crisis: January 2000 – December 2004 (%)

Figure 2. Export/Import ratio during the global crisis: January 2008 – September 2011 (%)

This commentary was published in Radikal daily on 26.11.2011