Commentaries

Fatih Özatay, PhD - [Archive]

Opinion follow-up: Do the credit expansion slow down? (2) 12/05/2011 - Viewed 1392 times

Banks do not slow down borrowing from the CBT to compensate the fall in the amount of deposits for credits.

In the first commentary of the "opinion follow-up" series written one and a half week ago, I said that I will continue with a similar topic. The main question I asked in my commentaries on the decisions of the Central Bank of Turkey (CBT) was the following: to what extent a central bank applying inflation targeting regime can slow down the credit expansion given that the liabilities of the banks are mainly short term?

The answer of the question should be clear as I stressed it several times in previous commentaries. I will repeat it once again today. But first I want to take a look at the developments in the context of the "opinion follow-up". The CBT has increased the required TL reserve ratio, which identifies the amount of reserves banks should keep at the CBT, six times since September 23, 2010. The CBT's target was to withdraw approximately 42 billion liras from the system, or in other words, to reduce the amount of funds banks can extend in form of credit by 42 billion liras.

The latest decision was a symbolic one

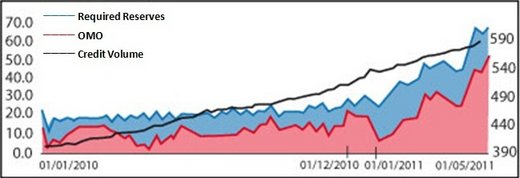

The latest decision on required reserve ratio was "symbolic" concerning its expected impact: approximately 2 billion TL as announced by the CBT. The impact of the previous decisions must be visible now. The step that was expected to cause the major drop in the volume funds that can be extended as credits was the decision before the last one: it became valid during the required reserve establishment period on April 15-28. The latest data available is the credit figures announced by the Banking Regulation and Supervision Agency (BRSA) on April 29, 2011 and data on the transactions between the CBT and banks dated May 6, 2011. The figure below shows the movement of the amount banks borrowed from the CBT (OMO) to offset the decrease in the volume of funds extended in form of credits, and the amount of deposits transferred to the CBT for reserve requirements. Credit data gives the figures for May 6, and the other two give the week average.

The policy did not work

Bad news for the CBT: if appears that the new monetary policy of the CBT implemented since September did not serve the purpose as the current outlook (as of May 2011) suggests. Credit volume maintains the upwards trend. Banks have compensated the funds the CBT seized through raising reserve requirements by borrowing from the CBT via open market operations. This way, they managed maintaining the rise in credit supply. The figure clearly reflects the upwards and parallel movement of both indicators (OMO and required reserves). Is this surprising? It is not. Let me summarize why once again for those who did not read my previous commentaries:

In order for the repurchase rate, the main policy tool of the CBT to ensure the price stability, to serve its purpose, it has to be close in value to the interest rate emerging from the interbank transfers. This condition can be met only if the CBT provides the short term liquidity banks demand.

Therefore, for the CBT to ensure the slowdown in credit expansion through increasing the required reserve ratio, banks must not be compensating for the fall in the volume of deposits to be extended as credits via borrowing from the CBT (unless the CBT ceases the inflation targeting regime). However, available data as of May 2011 reveal that banks did not slow down on this path.

Figure: Credit Volume (right axis), required reserves and the volume of banks' borrowing from the CBT (OMO): 2010 - First week of May 2011 (billion liras). Source: BRSA and CBT.

This commentary was published in Radikal daily on 12.05.2011