Commentaries

Fatih Özatay, PhD - [Archive]

Destabilizing interest expenditures 03/03/2011 - Viewed 1303 times

Turkey has a higher interest expenditure/GDP ratio than all European countries but Greece.

I am now obsessed with the 'stability' issue; I have to write stably on stability. Or I might harm the stability, God forbid. The concept "stability" has a dual character: there is "good stability" and "bad stability". Interestingly, the "things" stability evokes in our minds is not at all stable. Therefore, with a different perspective stability has no character.

In my last commentary I tried to exemplify the "bad stability". Today, I will emphasize how good it is to harm the stability, focus on the new stability ensured this way and maintain that instabilities prevail at the current state. I know it is too complicated. I guess this is what happens if editors let everyone to write commentaries.

The share of interest expenditures increased in the period of instability

Let me cut it short and start examining the share of interest expenditures in the public budget. In the era of macroeconomic instability, the share allocated from the budget for interest expenditures was quite high. We could talk about stability in this regard. Needless to say, this is an example for bad stability.

Since 2002 interest expenditures have been decreasing. According to the data of the Undersecretariat of Treasury, 71% of total tax revenues were spent for interest expenditures in 2003. The ratio dropped to 33% by 2006 and to 31% by 2009. We witnessed a substantial decrease also in 2010: 23%. In this sense, the stability of the share of interest expenditures in the budget was damaged, which was definitely a good thing. This bad stability played an important role in the reduction of inflation rate to single-digit levels and in the allocation of higher budget shares to other areas. This way Turkey enabled a more stable macroeconomic climate.

However, sustaining the low level of interest expenditures as a ratio to tax revenues; that is the phenomenon gaining a stable character might become a new source of instability for Turkey. I have to put forth an international comparison to clarify this point.

A considerable improvement is observed in 2010

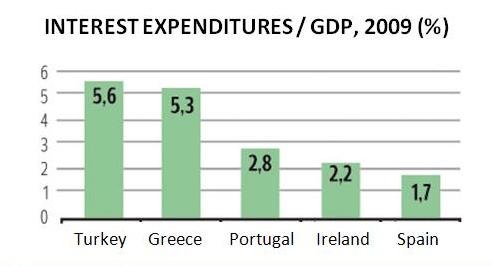

Comparing the outlook for Turkey with the troubled European Union countries might provide an insight in this respect. The latest available data was issued by the Eurostat and belongs to 2009. The data gives the ratio of interest expenditures to the gross domestic product (GDP), not to the tax revenues. But it is guiding anyway. The graph below shows the data for Turkey, Greece, Portugal, Ireland and Spain. Data on Turkey were retrieved from the Undersecretariat of Treasury.

Turkey has the highest ratio of public sector interest expenditures to the GDP. The said ratio is quite low in all other countries but Greece. Two warnings to highlight: First, it is estimated that the ratio for Turkey decreased from 5.6% in 2009 to 4.4% in 2010 which represents a significant improvement. Second, the ratios for the other countries examined will be much higher in 2010. To put it differently, the comparison will evolve in favor of Turkey. Nevertheless, I believe it is apparent that Turkey should reduce the share of budget resources allocated for interest expenditures to much lower levels.

Graph: Public sector interest expenditures / GDP: 2009 (%).

Source: Eurostat and Undersecretariat of Treasury of Turkey

This commentary was published in Radikal daily on 03.03.2011